The Medical Device Act 2012 has been gazetted on 9th February 2012 by the Malaysian Government. The Central Bank of Malaysia Act of 2009 Financial Services Act of 2013 and Islamic Financial Services Act of 2013 give BNM regulatory authority.

Financial Regulation Climate Change And The Transition To A Low Carbon Economy A Survey Of The Issues In Imf Working Papers Volume 2021 Issue 296 2021

Current issues and developments in accounting financial reporting and auditing 10 Total 100 EXAMINATION FORMAT.

. In 2017 the World Bank surveyed 750 multinational investors and corporations in developing countries to identify key parameters of investment decisions. As part of this process the Financial Technology Regulatory Sandbox Framework Framework is introduced to enable innovation of fintech to be deployed and tested in a live environment within specified parameters and timeframes. BNM and the Malaysia Deposit Insurance Corporation MDIC have published a policy document on Recovery Planning dated 28 July 2021 which aims to establish a policy framework to implement recovery and resolution planning RRP for financial institutions in Malaysia.

In addition to financial reporting requirements set above the following laws also apply to certain entities in Malaysia. For foreign companies it is a little different. In line with the FSB the regulatory and supervisory framework of Malaysia in respect of the banking and finance sector was consolidated under the Financial Services Act 2013 FSA and the Islamic Financial Services Act 2013 IFSA collectively the Acts both of which came into force on 30 June 2013 simultaneously consolidating and repealing the.

The first document is for financial institutions FIs such as banks payments providers insurers and money services businesses. Reporting entities are generally divided into two sectors public sector and private sector. Regulatory framework for financial reporting in malaysia Current Status.

In Malaysia the Medical Device Authority MDA is charged with the role of regulating medical device and its industry players. Legal Framework of the Malaysian Financial System. Both legislations received Royal Assent and were gazetted in.

This financial reporting framework applies to all local companies registered here in Malaysia. Foreign companies who are listed on the Malaysian Stock Exchange can prepare their financial statements or reports in accordance with certain internationally recognised accounting standards. In 2019 Malaysias central bank and financial regulator Bank Negara Malaysia BNM revised the existing Malaysia AMLCFT regime by introducing two policy documents applicable to two broad categories of financial entities.

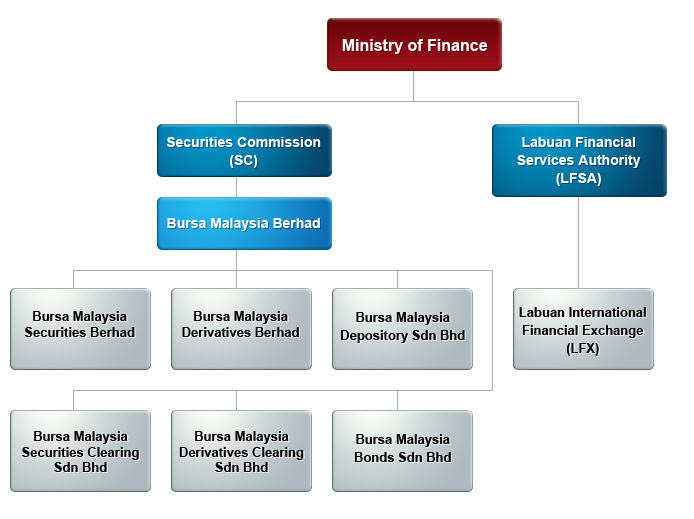

FINANCIAL REGULATORY FRAMEWORK IN MALAYSIA 1. And supervisory framework in steering the. In this article we discuss the financial reporting frameworks commonly used by entities in Malaysia.

The Financial Services Act 2013 FSA and the Islamic Financial Services Act 2013 IFSA will be two of the most significant pieces of legislation to impact the Malaysian financial services industry when they come into force. The Act which aims to provide a single uniform regulatory framework provides for the licensing regulation and supervision for money services business comprising of money changing remittance and wholesale currency businesses. 14 Bank Negara Malaysia Guideline Established in 26 January 1959 Some significant changes in late 1980 and early 1990 financial reporting practices Regulatory authorities began to play more influential role in the setting of financial reporting Bank and financial institution - first to make the move to practices full disclosure method as s.

Mahyuddin Khalid emkaysalamuitmedumy ISLAMIC FINANCIAL LEGAL FRAMEWORK LEGAL FRAMEWORK OF THE MALAYSIAN FINANCIAL SYSTEM. The RRP framework seeks to put in place an effective and efficient process to. View FINANCIAL REGULATORY FRAMEWORK IN MALAYSIAdocx from FINANCIAL FAR410 at Universiti Teknologi Mara.

To this end this paper attempts to evaluate the effectiveness of Malaysias regulatory. The Islamic financial system in Malaysia has been regarded as one of the most comprehensive systems in the world. A robust regulatorysupervisory framework enabling tax incentives.

Malaysias new financial services regulatory framework. Given that a regulatory. This is a 3-hour written paper consisting of two parts.

In Malaysia the money services business is governed by the Money Services Business Act 2011 Act 731 Act. This paper will also explore the unique regulatory and governance framework of Islamic banking in Malaysia by touching on the Islamic banking Act 1983 the Central Bank of. In line with the FSB the regulatory and supervisory framework in Malaysia in respect of the Islamic banking and finance sector was consolidated and updated under the Islamic Financial Services.

A financial system is deemed comprehensive when it has at the very minimum a fully functioning legal infrastructure. Regulatory Overview 1 AWS is committed to offering financial institutions in Malaysia a strong compliance framework and advanced tools and security measures which they can use to evaluate meet and demonstrate compliance with applicable legal and. The financial reporting framework is the framework that an entity uses to prepare its financial statements.

13 Risk and failure are an integral part of innovation. Of Malaysia needs more strategies to develop a comprehensive current sustainable policy and regulatory framework to suit the new business environment. CONTENT 2 ISLAMIC LAW SOURCES AND PRINCIPLES OF LAWS IN ISLAMIC BANKING AND FINANCE PRIMARY SOURCES SECONDARY SOURCES.

The Act was effective on 1 July 2013 and undergoes a transition period before it is fully enforced in 2014. Adopted Sources Relevant OrganizationsRelevant LegislationAccountants Act of 1967MIA By-LawsMIA Rules of 2001Relevant PublicationsCurrent Status of the Accounting and Auditing Profession in ASEAN Countries September 2014IFRS Foundation IFRS Application Around the World Jurisdictional. Sophistication vis-à-vis other Islamic financial centers.

An effective dispute resolution infrastructure. The regulatory framework. Code of professional conduct and ethics 45.

In Malaysia public sector entities. HISTORICAL PERSPECTIVE The origin of.

:max_bytes(150000):strip_icc()/BaselIIAccordGuardsAgainstFinancialShocks2_2-e24c7d4ba1f140128a1237b6a82efb40.png)

Basel Accords Guard Against Financial Shocks

:max_bytes(150000):strip_icc()/BaselIIAccordGuardsAgainstFinancialShocks1-fb23a015d23643009e189c8f43c74a03.png)

Basel Accords Guard Against Financial Shocks

Bnm Director Suhaimi Ali Explains Fintech Regulation In Malaysia Fintech News Malaysia

Regulatory Framework On Prs Private Pension Administrator Malaysia Ppa

Company Secretary Company Secretary Accounting Services Company

Pdf Financial Consumer Protection Regime In Malaysia Assessment Of The Legal And Regulatory Framework

Inceif Islamic Financial Services Act Ifsa And Financial Services Act Fsa

Pharmaboardroom Regulatory Pricing And Reimbursement Brazil

What Is Regulatory Framework In Accounting

26 Key Pros Cons Of Green Technologies E C

Pdf Regulatory Framework For Islamic Finance Malaysia S Initiative

Making Regulatory Compliance More Responsive To Change Bcg

Malaysia S Finance Minister Says Crypto Issuance Must Defer To Central Bank Bitcoin Btcpeek Freeb Cryptocurrency News Cryptocurrency Bitcoin Mining Hardware

Pdf Regulatory Framework For Islamic Finance Malaysia S Initiative

Pdf Regulatory Framework For Islamic Finance Malaysia S Initiative

Regulatory Governance And Independence Digital Regulation Platform

Inceif Islamic Financial Services Act Ifsa And Financial Services Act Fsa

Regulatory Framework For Infrastructure Asian Development Bank